Organisation : Financial Sector Conduct Authority (FSCA)

Facility Name : CIS / Hedge Funds Online Submission

Country : South Africa

Website : https://www.fsca.co.za/

How To Submit FSCA CIS / Hedge Funds Online?

The portal allows for electronic submissions

** Submission of Statutory Reports and Returns including Capital Adequacy reports, Annual Financial Statements, Mark to market report, Quarterly Portfolio holding reports and compliance certificates/reports and Quarterly Foreign Scheme Statistics

** Submission of advertising, marketing and information disclosure requirements for CIS

** Applications for new CIS, amendments, amalgamations and terminations for CIS

** Update user rights to be able to submit information on behalf of the Manager or Foreign Scheme it represents

Related / Similar Facility : FSCA Retirement Online System

Steps:

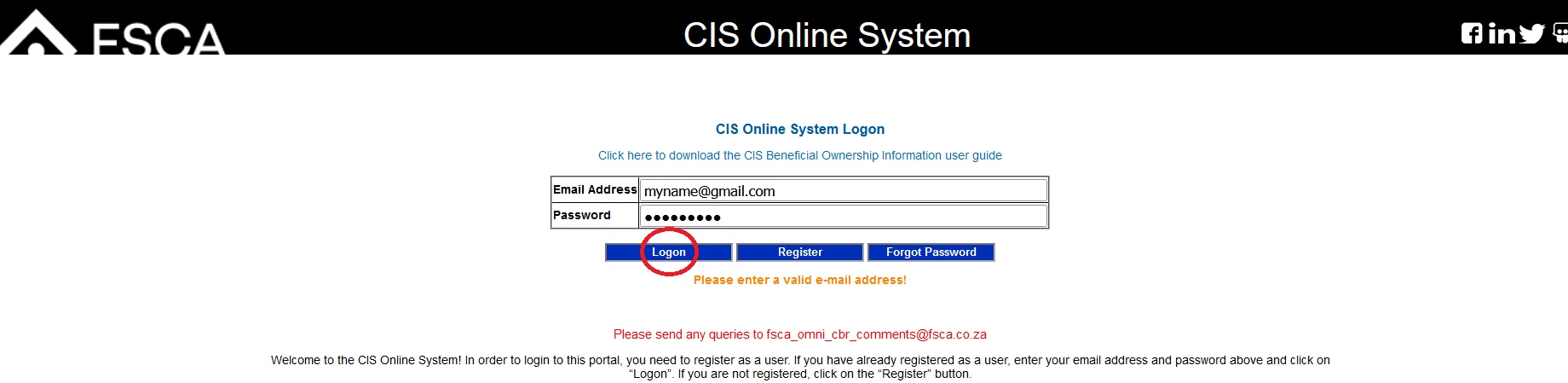

In order to login to this portal, you need to register as a user. If you have already registered as a user, enter your email address and password above and click on “Logon”. If you are not registered, click on the “Register” button.

Step-1 : Go to the link https://www.fsca.co.za/Regulated%20Entities/Pages/ES-CIS-Hedge-Funds.aspx

Step-2 : Click On “Register” Button

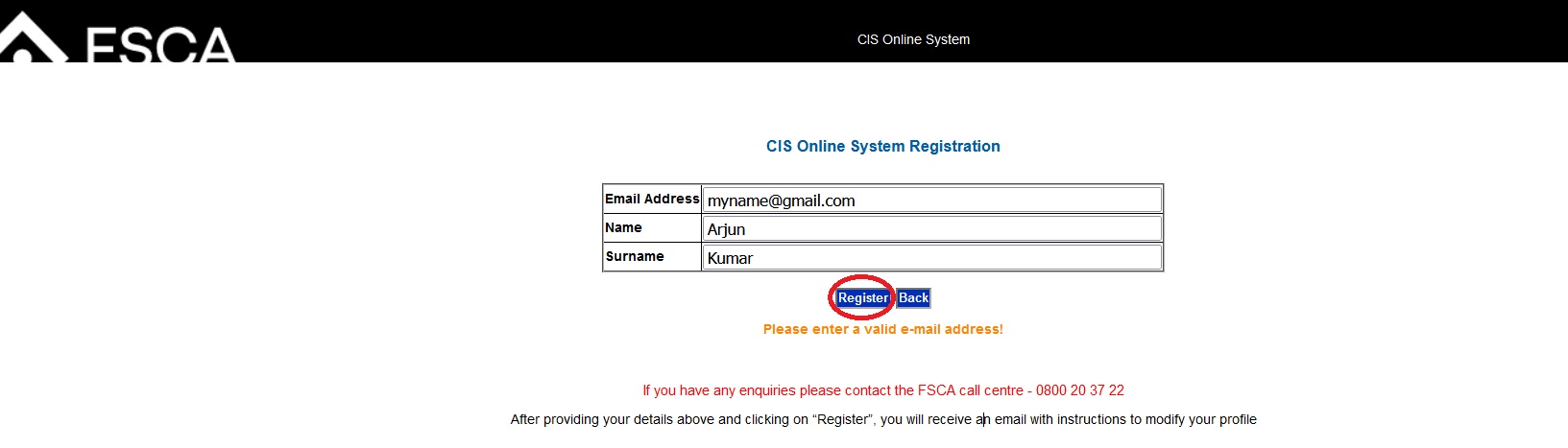

Step-3 : Fill the Online CIS Online System Registration Form and Click On ‘Register’ Button.

Step-4 : After Successful Registration, Login with your credentials to access ‘Online CIS System’.

Note:

After providing your details above and clicking on “Register”, you will receive an email with instructions to modify your profile.

FAQ On CIS

Frequently Asked Questions FAQ On CIS

What are the requirements in terms of marketing rules?

A manager may not advertise or market any collective investment scheme or portfolio in a manner that is likely to create a misleading or false statement. The advertisement should not be fraudulent or deceptive in any manner.

What are the advertising platforms that a manager can use?

The advertising platforms that a manager may use can be direct or indirect visual or oral communication transmitted by any medium. The manager may use brochures, prospectuses and websites as its advertising platforms.

Can a manager publish marketing and advertising information without lodging material with the registrar?

No. A manager must lodge with the registrar copies of all advertising and marketing material to be published by the manager prior to the publication or use of the material.

In which material should mandatory disclosures be made?

Mandatory disclosures must be included in all marketing material about that specific portfolio as well as on the MDD. The statements must be clearly shown for investors to read and understand.

How should the risk and disclosure requirements be made for portfolios that include foreign securities?

The disclosure of any material risk is expected prior to effecting the transaction. The method or medium is not prescribed and it should be considered as to whether the manager can prove that that disclosure took place when challenged thereon.

Is forecasting and commentary allowed?

Forecasts or commentary is only allowed about future performance of asset classes or markets in general- i.e. performance projections are not allowed; however it should be based on disclosed reasonable assumptions. It must also be accompanied with a statement that the included commentary is not guaranteed to occur.

Is comparative advertising allowed?

A manager may only make comparisons between its collective investment scheme or portfolio and another collective investment scheme or portfolio if the collective investment schemes or portfolios have sufficiently similar features and Commonality. The scheme or portfolio being compared to may not be mentioned by name. The information used when making comparison based on portfolio returns must be accurate and up to date.

Contact

If you have any enquiries please contact the FSCA call centre 0800 20 37 22